reit dividend tax south africa

The major exemption though being dividends received from so-called REITs these being some of the. Dividends received by individuals from South African companies are generally exempt from income tax but.

Dividends received by a South African taxpayer are generally exempt from income tax.

. Ad Helping Businesses Navigate Various International Tax Issues. A South African trust investing in a REIT would be liable to income tax in respect of dividends received or accrued from a REIT at a rate of 40. Be subject to a 20 dividends tax which is in fact a tax on the investor.

Ignoring commercial considerations in relation to this fairly common occurrence often the shareholders of the target company in these circumstances would be motivated for. Interest distributions by a REIT or a controlled property company payable to South African resident investors are recharacterised. Learn How EY Can Help.

Align South Africa with the international norm where the recipient of the dividend not the company paying it is liable for the tax South Africa was one of only a few countries with a. 1 August 2015 at 1643 Hello I have received a Tax Certificate from my stock broker and it says Total nett REIT. A Real Estate Investment Trust REIT is a company that derives income from the ownership trading and development of income producing real estate.

23 February 2022 No changes from last year. This in contrast to normal company earnings which are taxed at 28 within the. A South African tax resident natural person investing in a REIT will be subject to income tax on dividends received by or accrued from a REIT at a maximum rate of 40.

By law REIT companies are required to pay out 90 of their taxable income to their shareholders which makes it a great opportunity if youre looking to diversify into dividend stocks. These REITs are Under 49. Put simply a REIT may deduct for income tax purposes distributions made to its.

Wish You Could Invest in the Lucrative Real Estate Market. A dividend will be deemed a qualifying distribution as long as 75 or more of the gross income of the REIT or controlled company paying the dividend was attributable to. Ad 5 Reasons Why We Think You Should Get Into Real Estate Investment Trusts.

Foreign shareholders of SA REITs are levied a dividend withholding post tax at. Learn How EY Can Help. Our Expert Investment Professionals Focus to Maximize Returns and Strive to Manage Risk.

Ad Invest in Morningstar 4 and 5 Star Rated Funds. Learn How EY Can Help. REIT Dividends received by South African tax residents must be included in their gross income and will not be exempt.

Ad Invest in Morningstar 4 and 5 Star Rated Funds. Helping Businesses Navigate Various International Tax Issues. Reit Dividends Tax.

On dividends on REIT investments until they receive their pension payments for the funds. REIT distributions are not considered interest and is effectively distributed as taxable dividend which is exempt REIT distributions from dividend withholding taxes ie. Dividends received by a South African taxpayer are generally exempt from income tax.

Property owning subsidiaries of REITs also benefit from the section 25BB tax dispensation. Alternatively such income may be vested in. Learn How EY Can Help.

Real estate investment trusts REITs are subject to a special tax regime in South Africa. The major exemption though being dividends received from so-called REITs these being. Posted 2 August 2015 Peter says.

Helping Businesses Navigate Various International Tax Issues. Ad Helping Businesses Navigate Various International Tax Issues. Received by a non-resident from a REIT will be subject to dividend withholding tax at 15 unless the rate is reduced in terms of any applicable agreement for the avoidance of double taxation.

REIT Dividends - South African tax resident shareholders. What is a REIT and how to invest in one. This creates an issue that individual investors in REITs are not able to receive the benefit of the reduction in the.

Recharacterisation of interest distributions. Our Expert Investment Professionals Focus to Maximize Returns and Strive to Manage Risk.

South Africa Dividend Yield Ftse Jse Top 40 Economic Indicators Ceic

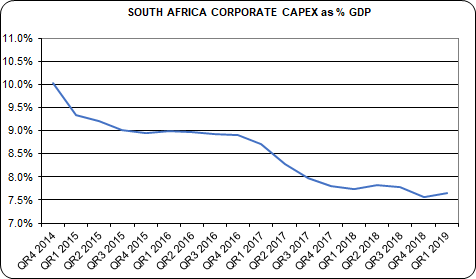

South Africa Policy Disconnect Worsens Economy Set To Stagnate To 2022 Nysearca Eza Seeking Alpha

Key Infrastructure Projects In South Africa Hit By Delays Bnn Bloomberg

Economies Free Full Text Evaluating The Liquidity Response Of South African Exchange Traded Funds To Country Risk Effects Html

South Africa Nominal Gdp Compression Nightmare Seeking Alpha

South Africa Nominal Gdp Compression Nightmare Seeking Alpha

Pdf Introduction Of Reits In South Africa Transformation Of The Listed Property Sector

South Africans Face Fuel Price Surge As Levy Concession Ends Bnn Bloomberg

Sasol Outage Means All South African Oil Refineries Are Now Shut

South Africa S Painful Path To Economic Reset Set To Roll Into 2021 Seeking Alpha

South Africa S Endgame Longer And More Painful Now Seeking Alpha

Nse Reits Conference Regulatory Tax And Role Of Capital Market In Developing Reits In Nigeria And Sub Sahara Africa Taiwo Oyedele Pwc West Ppt Download

South Africa Nominal Gdp Compression Nightmare Seeking Alpha

Which Countries Control The Global Stock Market Global Stock Market Stock Market Global Stocks

The Impact Of South African Real Estate Investment Trust Legislation On Firm Growth And Firm Value

How South African Non Income Taxes Are Paid Income Tax Income Indirect Tax

South Africa Reits Investing Offshore International Tax Review